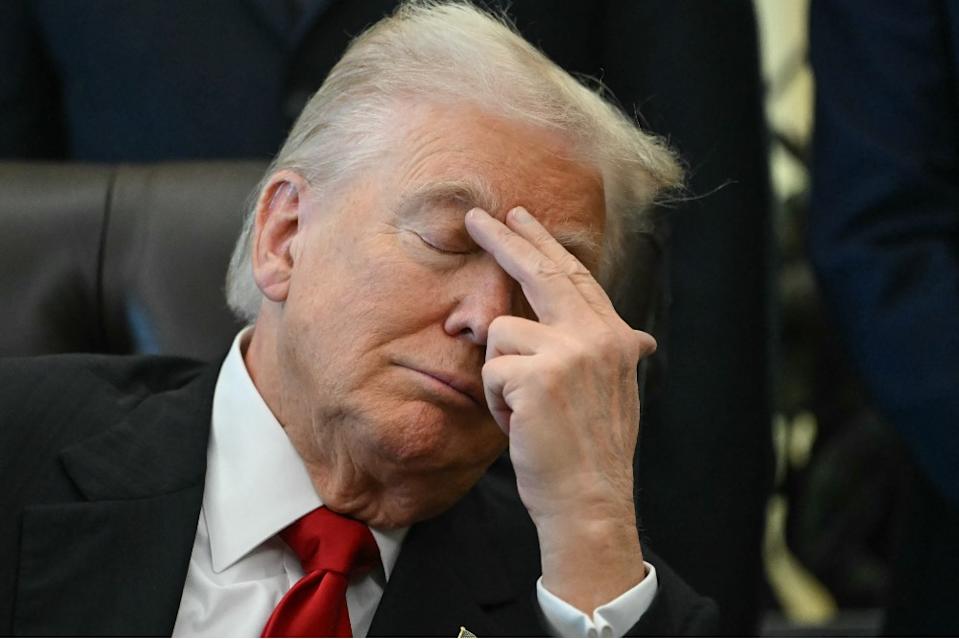

President Donald Trump appeared to attempt to drum up support for his increasingly unpopular “reciprocal” tariff regime—which was challenged in the nation’s highest court last week—by dangling the promise of hefty dividend checks for American citizens paid for with revenue from the duties.

In an early morning Truth Social post on Monday, Trump dinged tariff detractors using familiar epithets, writing that the United States has been raking in trillions of dollars in duties that will be used to pay down the ballooning national debt (now worth about $37 trillion). In addition, “[a] dividend of at least $2000 a person (not including high income people!) will be paid to everyone.”

Treasury Secretary Scott Bessent told ABC that the specifics of the massive payout to Americans hadn’t yet been discussed by officials in depth. But he seemed to temper the president’s claim, saying, “The $2,000 dividend could come in lots of forms, in lots of ways. You know, it could be just the tax decreases that we are seeing on the president’s agenda—you know, no tax on tips, no tax on overtime, no tax on Social Security, deductibility of auto loans.” So, no checks in the mail (a la Covid-19 stimulus), according to the country’s chief of finance.

The president’s restlessness over the fate of the International Emergency Economic Powers Act (IEEPA) tariffs has been on display since they faced harsh scrutiny in a long-awaited Supreme Court hearing last Wednesday.

Conservative judges evinced similar doubts to their liberal counterparts about the president’s authority to wield the wide-ranging duties against more than 100 U.S. trading partners, and a number of the justices equated tariffs to taxes on Americans, which only Congress has the power to impose.

Solicitor General D. John Sauer also appeared to contradict the president’s oft-repeated justification for the tariffs: that they will line the country’s coffers and Make America Rich Again, so to speak. Seeking to draw a line in the sand between tariffs and taxes, Sauer said the revenue raised by the duties is purely “incidental,” and that their primary function is to regulate foreign commerce. That assertion drew dubious replies from the justices.

In questioning both Sauer and the lawyers for the petitioners, the justices sought to clarify whether IEEPA indicates or implies that tariffs can be used as a tool by the president in the event of an “unusual and extraordinary threat” from a source outside the U.S. The statute does not include the words “tariffs” or “duties,” the solicitor general admitted, though it does say the president can “regulate” imports and exports. Throughout the 69 instances that IEEPA has been leveraged since it was established in 1977, no other Commander in Chief has used it to impose tariffs.

The justices now have the responsibility of parsing the parties’ arguments and considering more than 40 “friend of the court” briefs provided by all manner of stakeholders, from American businesses to lawmakers. The vast majority support the petitioners’ case.

For weeks leading up to and following the oral arguments, the Trump administration has hinted that it has other tools in its toolbox to impose tariffs should the IEEPA duties be invalidated by the Supreme Court. Section 232 of the Trade Expansion Act of 1962, Section 301 or Section 122 of the Trade Act of 1974 and Section 338 of the Tariff Act of 1930 may be among the levers left to pull. They each confer different authorities for imposing tariffs, but also contain provisions that threaten to slow Trump’s heretofore rapid roll.

The president alluded to these options on Sunday, writing, “So, let’s get this straight??? The President of the United States is allowed (and fully approved by Congress!) to stop ALL TRADE with a Foreign Country (Which is far more onerous than a Tariff!), and LICENSE a Foreign Country, but is not allowed to put a simple Tariff on a Foreign Country, even for purposes of NATIONAL SECURITY.”

On Monday, the president’s anxieties about the Supreme Court decision were palpable, mostly centering on what will happen if the federal government is forced to pay back the IEEPA duties it’s collected already.

“The actual Number we would have to pay back in Tariff Revenue and Investments would be in excess of $2 Trillion Dollars, and that, in itself, would be a National Security catastrophe,” he wrote.

Following the Supreme Court hearing, Jason Kenner, a lawyer for Sandler, Travis & Rosenberg, explained that the refund process may not be straightforward. Should the petitioners prevail, they alone will be refunded as a direct result of the ruling.

“As to a refund process, the solicitor for the for the states and importers raised the issue of potential protest, and that could be a possibility. It may take people filing their own actions in the Court of International Trade or Congress, or the courts may do some sort of legislative or judicial fix and order refunds,” he said.

Trump’s misgivings about the potentially disastrous impact that refunds could have on the federal government aren’t likely to factor into the Supreme Court’s decision, though Justice Amy Coney Barrett did query the lawyer for the petitioners, Neal Katyal, about whether doling out restitution to payees would be “a mess.”

“I don’t think the messy nature of a refund process would justify finding the tariffs to be constitutional,” Kenner said.

And the process doesn’t need to be a painful one, he argued. “The refund process doesn’t have to be messy. It’s only going to be messy if that’s what the government wants to do,” he said. “Customs takes in money; it refunds money on a daily basis. That’s what it does. It has computer systems, it has all the data of who paid and how much they paid, and they can issue refunds electronically through their system.”